“Empowering transactions with a secure chip, integrated circuit cards pave the way for a safer financial future”

What is Integrated Circuit Card?

An integrated circuit card, commonly known as a chip card, is a type of payment card that includes a small microchip embedded within it. This chip securely stores information related to the cardholder’s account. Unlike older cards that rely solely on a magnetic stripe to store data, chip cards provide an additional layer of security. Integrated circuit cards made from plastic or a similar material, chip cards utilize the embedded microchip to authenticate transactions, enhancing security and reducing the risk of fraud compared to traditional magnetic stripe cards.

Application/Examples Of Integrated Circuit Card

- Payment Transactions: Integrated Circuit cards enable secure purchases for groceries, public transport, and online shopping.

- Access Control: They grant entry to buildings, offices, and restricted areas with a simple tap or insertion.

- Identification: Integrated circuit cards verify identity at checkpoints like border controls or medical facilities.

- Loyalty Programs: They facilitate earning points or rewards at retailers, fostering customer engagement and repeat business.

Why Integrated Circuit cards are preferred over magnetic stripe?

- Each transaction generates a unique code, making it harder for fraudsters to replicate data. Chip cards utilize dynamic authentication, encryption, and PIN verification, providing higher security . while magnetic stripe cards have static data that can be easily copied or skimmed by fraudsters.

- The physical chip in chip cards is much more difficult to tamper with compared to the magnetic stripe, which can be easily cloned or altered.

- Chip cards are safer worldwide due to consistent security standards, offering confidence in transactions across different regions. In contrast, magnetic stripe cards may pose risks abroad due to varying security measures and standards.

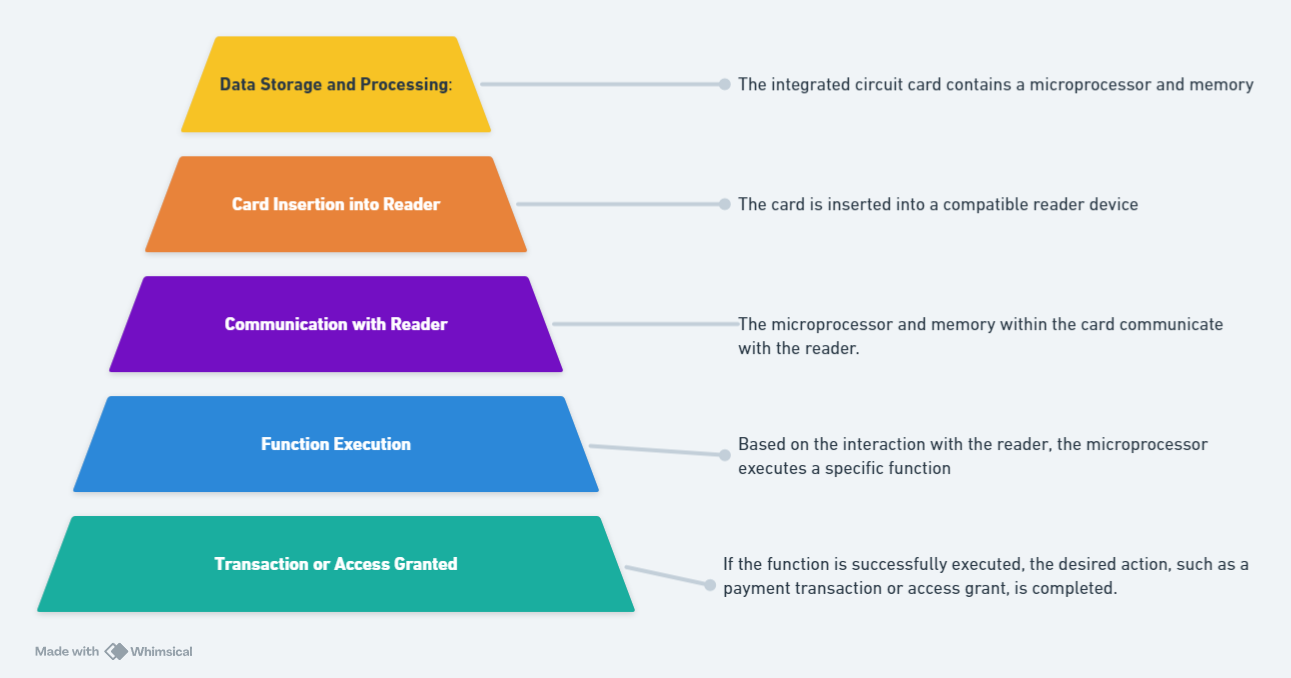

How Integrated Circuit Cards Work

- The microprocessor is like a tiny computer chip that can perform tasks, while the memory stores information like personal data and monetary value.

- When you place the card into a reader, it establishes a connection between the card and the reader.

- The card and reader exchange information, such as verifying the card’s authenticity and accessing stored data.

- Depending on the purpose of the interaction (e.g., payment transaction, access control), the microprocessor carries out the necessary calculations and instructions.

- Once the microprocessor completes its task and any necessary verification steps, the transaction or access is authorized and carried out.

Conclusion

Integrated circuit cards, or chip cards, offer a superior level of security and reliability compared to traditional magnetic stripe cards. With dynamic authentication, encryption, and tamper-resistant technology, chip cards significantly reduce the risk of fraud in transactions. Their global acceptance and consistent security standards make them the preferred choice for secure payments worldwide. By leveraging the power of microprocessor technology, chip cards ensure that each transaction is conducted safely and efficiently, providing peace of mind to cardholders and businesses alike.